希腊国民银行10月17日称,已经结束与来自中国的宫保集团就收购Ethniki保险公司(译称”国民保险”)的谈判。同日,宫保集团对此发表声明。

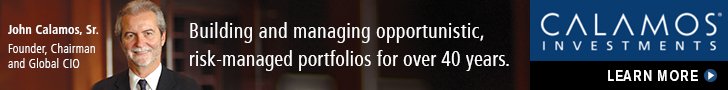

今年5月23日,宫保主席王征(左一)与中国工商银行代表再次拜访国民银行。 图中为希腊国民银行总裁米罗纳斯。(资料图片)

《希华时讯》在10月17日午间收到来自宫保集团的声明。其中提到,宫保集团在10月16日收到来自希腊国民银行的信函,知悉该行董事会已单方面决定终止与宫保集团对收购Ethniki保险公司的谈判。声明称,“我们认为这一决定及其原因是站不住脚的。通过即席会议的方式来宣告结束与宫保的谈判是不负责任且别有用心的。这无疑是黑暗的一天。”

声明还提到,“值得注意的是,在第一轮投标中,当时实际上还不存在的美荷财团Calamos-Exin提交报价31天后,卖家希腊国民银行就宣布其中标,其后等待9个月直到美荷财团无法筹资而宣告交易流产,国民银行始终没有就此要求补偿。与此相比,在过去两年中,宫保集团一直支持希腊国民银行以及Ethniki保险公司。在复星集团最后一刻退出投标后,宫保集团仍坚持作为该项目的唯一投标者提交约束性报价。我们始终认为这个项目可以作为增进中希关系的基石之一。”

“在收购Ethniki保险公司的项目上,宫保集团得到了中国工商银行的支持,这也是中国的商业银行首次支持企业投资希腊项目。宫保的自有资金以及银行贷款是可靠的,但可惜的是,希腊国民银行对实实在在的出价置若罔闻。”

声明直指希腊国民银行总裁米罗纳斯需要为此前美荷财团交易流产,以及为宫保收购国民保险项目“无疾而终”负责,认为他“造成了第二个丑闻”。

声明最后称,宫保集团将保留采取法律行动的权利。

今年5月22日,宫保主席王征(左二)及其投资顾问、法国前总理德维尔潘(左三)等 再次拜访希腊央行。左四为央行行长斯杜那拉斯。(资料图片)

在宫保集团发出上述声明前,希腊国民银行曾发函称,在未来不会再就Ethniki保险公司出售项目与宫保集团进行谈判。另外,希腊国民银行还称,未来在银行业务重组计划的框架下,仍然会致力探寻多种解决方案,并会在适当的时候通知潜在投资者。

Ethniki保险公司成立于1891年,是希腊历史最悠久也是最大的保险公司,由希腊国民银行控股。该银行从2016年11月开始为出售Ethniki保险公司至少75%股权寻找买家。

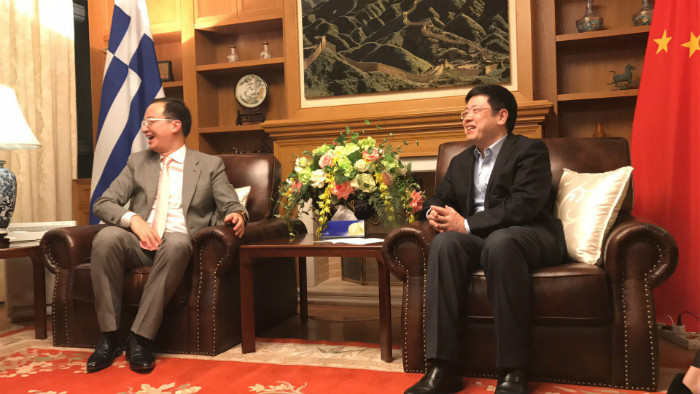

宫保主席王征及中国工商银行代表与希腊总理齐普拉斯、副总理德拉加萨基斯、 经济发展部副部长比齐奥拉斯、金融稳定基金主席米歇里斯等进行会谈(资料图片)

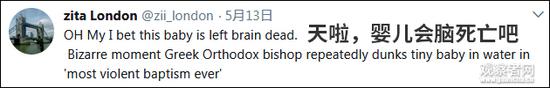

2017年3月21日,时任中国驻希腊大使邹肖力会见宫保主席王征(资料图片)

但是,Ethniki保险公司出售过程波折重重。在第一轮中标方美荷财团Calamos-Exin未能于今年3月28日最后限期前完成对Ethniki的收购后,卖方希腊国民银行随即为该项目重新寻找投资者。6月7日,复星集团在最后一刻退出对该项目的第二轮投标,同样来自中国的宫保集团作为该项目的唯一投标者提交了约束性报价,出价6.76亿欧元收购Ethniki75%股权。但此后这个项目一直没有进展。

早前已有消息透露,希腊国民银行考虑到当前投资大环境仍未如理想,因此对重新启动出售进程一直持犹豫态度。(梁曼瑜)

附:宫保集团声明全文(英文)

Notice in Response to the Termination of the Sale Process by NBG

On 16 October 2018, we received a letter (the “Letter”) from the National Bank of Greece (“NBG”). The Letter stated that the Board of Directors of NBG (“NBG Board”) has met on the previous day. In such meeting, the NBG Board unilaterally decided to terminate all discussions with Gongbao Financial Holdings Limited in respect of the sale process for Ethniki Hellenic General Insurance S.A. (“Ethniki Insurance”).

We consider the decision and the reasons thereof are untenable. The process of making such a decision, which apparently through merely an impromptu meeting, to abruptly and brutally terminate the discussion with Gongbao is irresponsible but with ulterior motives. This is another notorious scandal after US based EXIN, both caused by Mr Mylonas. This is no doubt a day of darkness!

It should be noted that in stark contrast with US based EXIN case, it took NBG only 31 days to accept EXIN’s surreal offer and executed the transaction documents , despite that EXIN’s fund was actually non-existing at that time. Miraculously , NBG waited patiently for nine months, only to witness EXIN’s failure to raise the fund needed to complete the transaction. EXIN exited without a consequence and NGB accepted it without receiving any compensation.

Over the past two years, despite EXIN’s failure and Fosun’s withdrawal in the last minutes, we invariably supported NBG and Ethniki Insurance and participated in the sale process as the sole and only bidder until the end, as we considered this project as one of the main cornerstones of the growing relationship between Greece and China. In this connection, we obtained the continuous support from ICBC. This is the first time ever a commercial banking group of China supporting a Greece project.

As a result, Mr Mylonas and NBG shall be held responsible for their conduct and decision in this matter, and for turning a blind eye to Gongbao’s solid offer of EURO 350 million cash together with bank facilities of up to EURO 450 million undertaken by ICBC, the largest and one of the strongest banking groups worldwide.

We reserve our rights to pursue legal actions.

All things come out of the one, and the one comes out of all things. May God bless NBG and Greece!

Gongbao Financial Holdings Limited

17 October 2018

(声明:希华时讯独家稿件,未经授权禁止转载)